Top Stories

BP eyes more spending cuts after 80 percent profit drop

BP said on Tuesday it could cut capital spending further after reporting an 80 percent drop in profits in the first quarter of the year, when oil prices touched a near 13-year low. The British oil company, the first major to report on one of the weakest quarters, lowered its 2016 spending target to $17 billion, from $17-19 billion, and said the marker could fall to $15-$17 billion next year if oil prices remain weak. These cost reductions have enabled the oil producer to forecast it can balance its books at an oil price of $50-55 a barrel in 2017, it said, down from $60 previously eyed. BP shares opened 3 percent higher on the London Stock Exchange on Tuesday, the second-biggest gainer in the blue-chip FTSE 100 index. Chief Executive Bob Dudley said he […]

Texas, Oklahoma, Wyoming: Oil Woes Start to Hit Hard

There are some early signs of delinquency-rate… The slump in crude prices is starting to show up as missed payments by consumers in the oil patch. In states from Oklahoma and Texas to North Dakota and Wyoming, rising unemployment in the energy sector is pushing up loan delinquencies and raising the risk of new losses for banks. Overall, energy-dependent states are posting delinquency rates that in many cases exceed the national average, according to data prepared for The Wall Street Journal by credit bureau TransUnion. “In these energy states, we are clearly seeing the impact of the loss of oil jobs,” said Ezra Becker, senior vice president and head of research at TransUnion. “We don’t expect to see any kind of material improvement in the short term.” Some 119,600 oil and gas jobs nationwide have been eliminated—22% of the total—since September […]

Oil Rising Faster Than Ruble Bolsters Russia’s Revenue Outlook

The outlook for Russia’s earnings from oil exports is improving as the price of a barrel of crude in ruble terms rose to the highest in more than five months. The currency’s 2.8 percent advance this month has lagged a gain of 18 percent in Brent crude, which is used to price Russia’s main export blend. The exchange rate’s relative weakness means the government is earning more from sales of the dollar-denominated commodity. The ruble was little changed at 65.18 per dollar by 12:33 p.m. in Moscow as Brent rose 2.4 percent to $46.84 a barrel, or 3,052 rubles. The oil-price recovery is bringing relief to the government as it seeks funds to bridge what analysts project will be the biggest budget deficit as a percentage of economic output since 2010. This year’s fiscal plan was based on the state receiving 3,165 rubles for each barrel it sells. The […]

Can Oil Continue To Rally Like This?

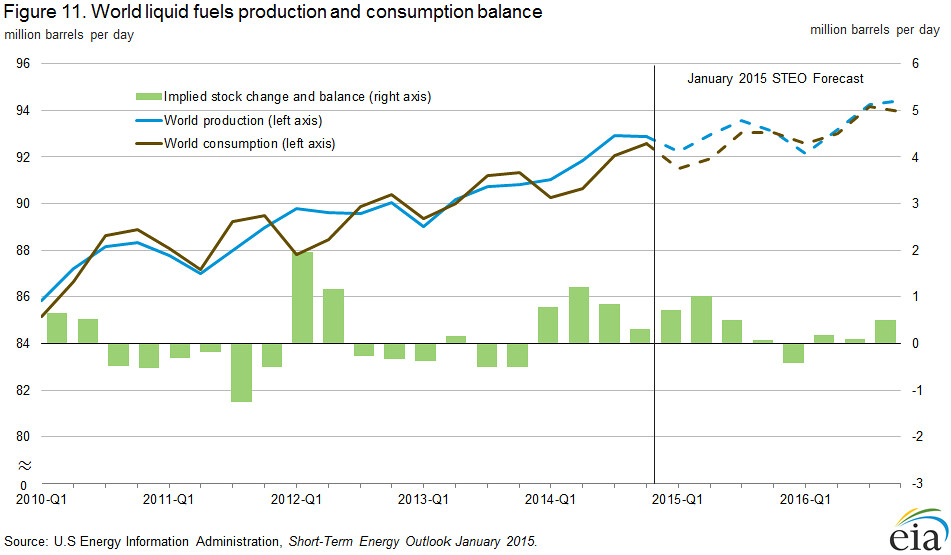

The collapse of the rig count and depressed drilling activity has already knocked about 700,000 barrels per day of oil production offline. • But the rig count could bottom out this year and begin climbing again. However, the EIA doesn’t expect oil production to rise in the short run even if the rig count rebounds. Oil production is expected to continue to fall through 2017 as too few new wells come online to replace rapidly falling shale output. • Total U.S. oil production is expected to fall from 9.43 mb/d in 2015 to 8.04 mb/d in 2017, a figure that includes rising output from […]

Unpaid bills add to China debt problems as receivables mount

Times have changed for Yu Xingzhi since China’s economic boom years. Despite the slowing economy, sales at Shanghai Caison Color Material Chemical are holding up. The trouble is, her customers — garment manufacturers and packaging producers buying her dyes and inks — are taking more time to pay for what they buy. “Receivables are the unavoidable problem for traditional manufacturers. If you don’t accept receivables, you have no business. It’s standard industry practice, even though no one likes it,” says Ms Yu, the dyemaker’s general manager. It is a vicious circle and one threatening the health of the economy. Ever longer delays in bills being paid are creating a chain of squeezed cash flow and debt that runs from large state-owned enterprises through to smaller suppliers and even employees struggling to pay their own bills. Listed companies had to wait a median 70 days to receive payment last year, […]