Top Stories

Oil Prices Fall On Unexpected EIA Barrel Build

One hundred and sixteen years after the birth of Woody Woodpecker creator and animator Walter Lantz, and WTI crude oil is knocking on the door of $45 – and knocking on wood that U.S. production is wilting. Here are six things to consider about the oil market on this final Wednesday in April: 1) Today is set to be dominated by a game of two halves; inventories this morning, and Federal Reserve rumblings this afternoon. While the API inventory report points to a draw to crude stocks (h/t lower imports), expectations of dovish rhetoric from the Fed is putting downward pressure on the dollar. Hence, crude is once again pushing on to new highs for the year. The bullish sentiment for oil however did not last long after the DOE surprised by contradicting the API and reporting a significant build in U.S. crude stocks. 2) A piece today talking […]

Analysts Aren’t Buying the Oil Rally

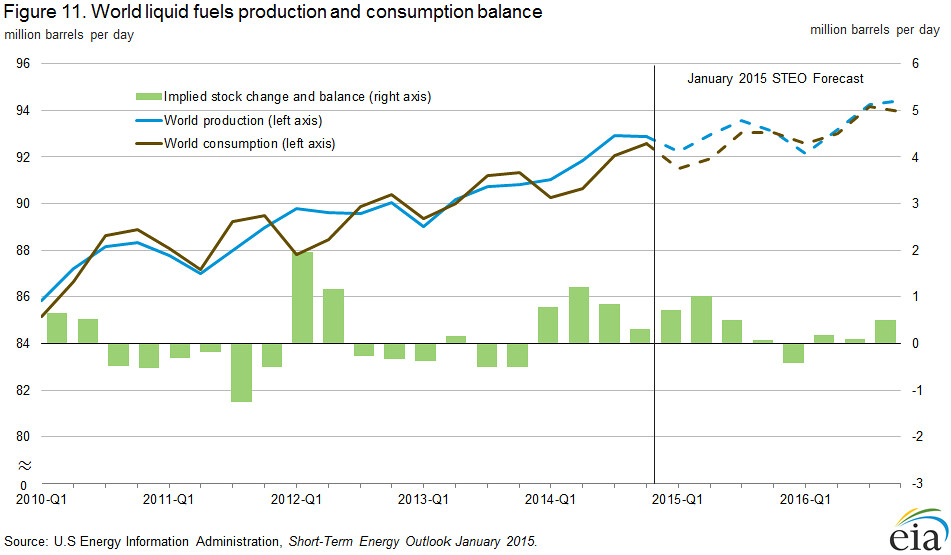

Even as oil rallies, analysts have barely nudged up their price forecasts as they worry that crude’s current gains might not be sustainable. The price of oil has jumped by around 70% from the decade-lows it hit earlier this year. That is mainly on hopes that dwindling U.S. oil production will help take crude out of an oversupplied market. But many analysts aren’t buying the rally. They question whether the glut is indeed on the wane given current stockpiles and the potential for increased supply from Iran and elsewhere. They point out that last year, the oil price also rallied in the spring on a belief that supply was falling, only to collapse in the second half of the year. A survey of 13 investment banks by The Wall Street Journal sees Brent crude, the international oil-price benchmark, averaging $41 a barrel this year, up a dollar from the […]

Something Has To Give – Goldman Sachs Expects More Dividend Cuts

It hasn’t been a great week for Big Oil. BP reported an 80 percent decline in earnings, and ExxonMobil lost its coveted AAA credit rating , which it has held uninterrupted for more than eight decades. Low oil prices are still wreaking havoc on the industry, hollowing out profits and forcing companies to cut back on spending and personnel. It is a sign of the times that BP’s $532 million net profit – which excludes nearly $1 billion in fresh charges from the Deepwater Horizon disaster way back in 2010 – beat analysts’ estimates and was considered a very positive result. BP’s share price jumped more than 5 percent on April 26 following the results. But the oil majors are still hurting. And it is unclear whether or not they can maintain their generous dividend policies. BP’s dividend yield now exceeds 7 percent and Royal Dutch Shell has a […]

Why Saudi Arabia Will Not Win The Oil Price War

Crude oil prices continued to surprise on Tuesday, with the U.S. benchmark adding another 4 percent to $44.60 a barrel. West Texas Intermediate is now up 65 percent since hitting 13-year lows below $27 a barrel February 11. It’s a performance only bettered by the globe’s second most traded bulk commodity – iron ore. But like analysts of the steelmaking raw material, many in the industry have been surprised by the extent of the rally, consistently calling the oil price lower. The blame for the cloudy outlook for crude is mostly being laid at the door of Saudi-Arabia. After the collapse of the Doha talks to freeze production and amid a spat with the U.S. over terrorism , the world’s top producer has threatened a scorched earth policy when it comes to maintaining and growing its market share. But there is an alternative view out there that argues that […]

Venezuela Needs Oil’s Rally More Than Anyone as Economy Teeters

Few countries need oil’s rally to last more than Venezuela, where the economy’s expected to shrink 8 percent this year and a lack of petrodollars has seen shops run short of consumer goods. The Latin American nation with the world’s largest oil reserves relies on crude shipments for 95 percent of export revenue. It will default this year barring a large jump in the oil price or a financial bailout, said Thomas Olney, a London-based analyst at consultants FGE. Credit-default swap traders have put the chances of non-payment through June next year at 67 percent, according to data compiled by Bloomberg. Following the collapse of oil-freeze talks in Qatar this month, Venezuelan Energy Minister Eulogio del Pino warned crude may revisit the 12-year lows of earlier this year as supply continues to swamp demand. Even with a rebound since February, prices remain 60 percent below their 2014 high. That’s […]